When Bloomberg reported that Facebook was conducting market research to gauge interest in an ad-free, paid subscription model, we decided to do a bit of our own research.

Facebook — to most consumers, at least — has long served as a free product. Advertisers, content creators, and publishers have enlisted the platform’s various services for a fee, accounting for roughly 98% of its annual revenue in 2017.

But for those of us who use the network to consume content — whether it’s from friends and family, or publishers — it’s essentially been a monetarily “free” product. That

The company has faced a high degree of scrutiny and fallout since then — even

So maybe the network wasn’t really “free,” after all. Maybe, to certain parties and Facebook itself, what we shared and engaged with on the site had a dollar amount attached to it.

That’s been the case for a while in the vein of the company’s ad revenue: marketers and advertisers can target promoted content to users based on the data Facebook has about them — criteria like age, location, gender, interests — without attaching personally identifiable information to it.

But is it worth paying to opt out of those ads?

Measuring Public Interest in an Ad-Free Facebook Subscription

How Many Would Pay?

According to Bloomberg‘s report, any plans for an ad-free subscription model at Facebook are currently speculative — and may not come to fruition at all. And, writes reporter Sarah Frier, these plans are not new, though the recent fallout over data and how it’s used to shape ads has ignited a conversation around the possibility.

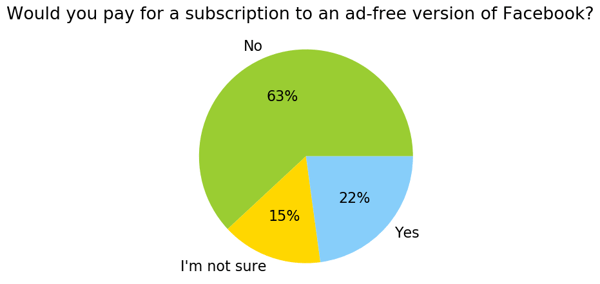

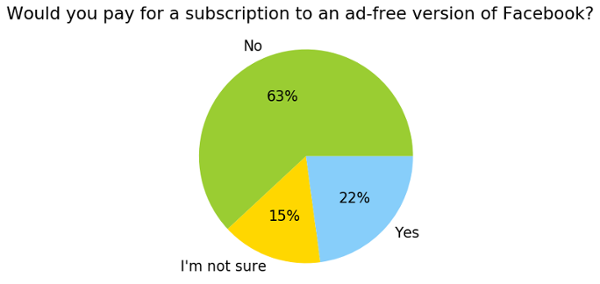

We surveyed a panel of 893 consumers — almost evenly divided among the U.S., UK, and Canada — to find out how many people would pay for a subscription to an ad-free version of Facebook.

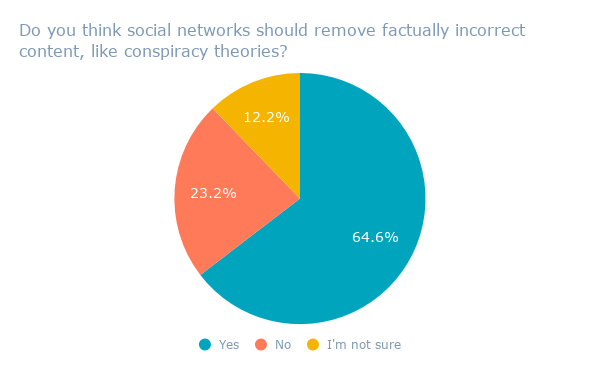

The response indicated a fairly widespread disinterest in such a subscription, with an average 65% of participants saying that they would not pay for one.

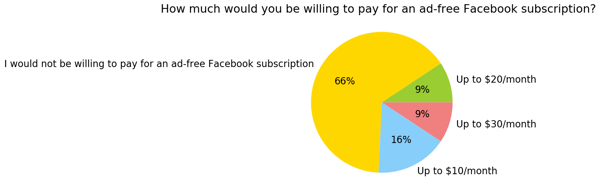

U.S. results — 304 responses

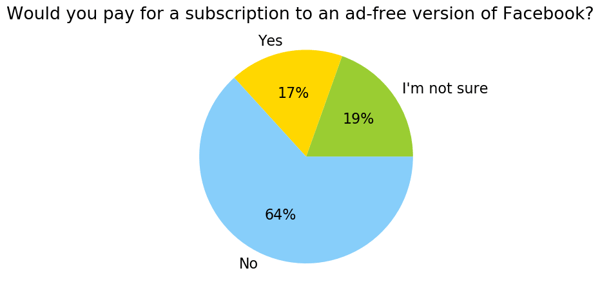

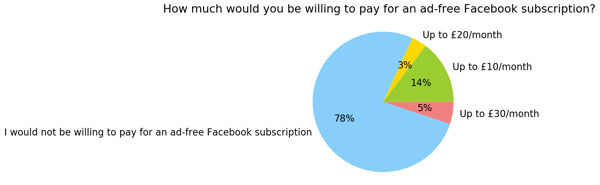

UK results — 302 responses

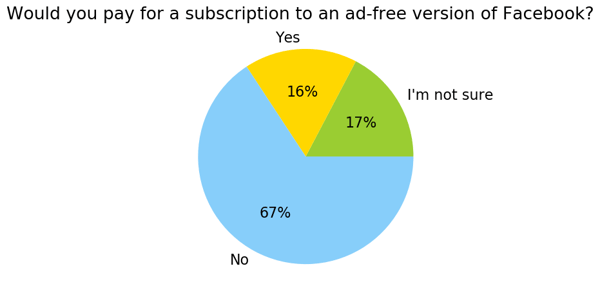

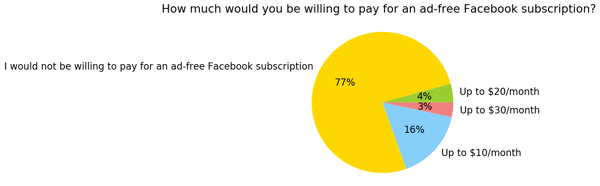

Canada results — 287 responses

What is interesting to note is that, within the U.S., 22% of consumers would be willing to pay for an ad-free Facebook subscription, versus just 17% and 16% in the UK and Canada, respectively.

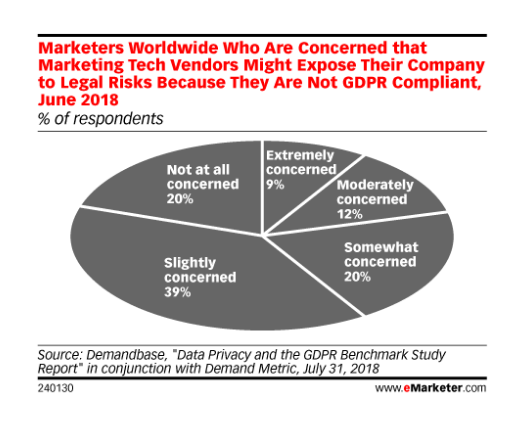

That could be due to a lack of strict, formalized data privacy laws in the U.S., which could cause a greater perceived value of paid protections. The UK will be subject to the General Data Privacy Regulation (GDPR) when it comes into force on May 25 — until Brexit takes effect in 2019 and the UK separates from the EU.

Canada, for its part, also has fairly extensive data privacy laws.

But here’s a crucial discrepancy: Even if users paid for an ad-free subscription service, it’s not clear if the data used to personalize ads would still be collected and stored.

At F8 — Facebook’s annual developer conference, CEO Mark Zuckerberg did announce a “Clear History” feature to be rolled out in the next several months that would allow users to see which websites and apps send Facebook information on when they’re used, and delete that information from their accounts.

And while the announcement indicated that users will also be able to turn off Facebook’s access to and storage of that information in their accounts moving forward, it’s not clear the nature of what data will be accessed and stored.

It’s also important to note that even if users delete their Facebook accounts entirely, your online behavior can still be tracked via the Facebook Audience Network, which equips advertisers on the network with various tools and pieces of code to “extend their campaigns beyond Facebook.”

Source: Facebook

Facebook’s influence on internet users outside of Facebook was something Representative Joe Kennedy asked about during Zuckerberg’s testimony before the U.S. House of Representatives last month — in what The Atlantic called “the most important exchange” of the hearing.

Kennedy questioned the Facebook CEO’s repeated claim that users have complete control over their data.

“One of the challenges with trust here is that there is an awful lot of information that’s generated that people don’t think that they’re generating and that advertisers are being able to target because Facebook collects it,” Kennedy said. “I don’t understand how users then own that data.”

It’s unclear, therefore, if a paid, ad-free subscription would resolve that.

How Much Would They Pay?

For those who are willing to pay, however, what cost are they willing to assign to an ad-free experience?

We posed that question to 907 consumers — again, almost equally divided among the U.S., UK, and Canada — and found that, once again, most people (an average of 71%) would not be willing to pay for an ad-free Facebook subscription.

But out of those, most — an average of 15% — would be willing to pay up to $10 a month (or £10 in the UK) for such a service.

U.S. results — 299 responses

UK results — 312 responses

Canada results — 296 responses

An ad-free Facebook subscription wouldn’t be unprecedented — in fact, it aligns with the ad-free subscription models with many other players within the tech realm. Music streaming service Spotify offers an ad-free premium membership for $9.99 per month, while Pandora, one of its chief competitors, offers ad-free plans ranging between $4.99 and $9.99 per month.

Hulu, a TV-streaming service, offers a limited commercial plan for $7.99 per month, and a commercial-free subscription for $11.99 per month. And Netflix, another TV- and movie-streaming service, offers subscriptions for up to $13.99 per month.

Where We Go From Here

Even if Facebook does introduce a paid subscription model, its executives have repeatedly emphasized that there will always be a free version of it. COO Sheryl Sandberg previously told Bloomberg as much, and Zuckerberg did the same in his Congressional testimony.

ZUCKERBERG: “There will always be A VERSION of Facebook that will be free.”

— Amanda Zantal-Wiener (@Amanda_ZW) April 10, 2018

“I wouldn’t be surprised if some users would be interested in this experience — it’s the same experience we have with Netflix, Spotify, Amazon, and other modern tech companies that offer ad-free options,” says Henry Franco, HubSpot’s social campaign strategy associate. “The question is how much of a value people put on their data. Would the average person be willing to pay $10 per month if it meant advertisers couldn’t use their data?”

If so, at that price point, Facebook could stand to earn a fair amount. With an estimated 214 million users in the U.S., for example, if 16% of them (34.24 million) are willing to pay $10 per month for an ad-free subscription, it adds up to $342.4 million in revenue each month — or $1.0272 billion per quarter.

However, that number still somewhat pales in comparison to the $11.795 billion in ad revenue that Facebook reported in its Q1 2018 earnings call.

And even with all these factors, the question of how user data would be leveraged, if at all, still lingers in Franco’s mind.

“Would Facebook still collect data on these users even if they didn’t use it for advertising?” Franco asks. “Your data might be worth $100 each year to Facebook, but you have to wonder if the average user would be willing to pay $100/year for Facebook not to get it.”

Deje su comentario